Central Securities Depository of Iran

Mohammad Baghestani

Chief Executive Officer & Board Member

| Address | No. 13, Naderi St., Keshavarz Blvd., Tehran, Iran Postal Code: 1416643168 |

|---|---|

| Telephone | 00982142365732 |

| Fax | 00982142365186 |

| intl@csdiran.ir | |

| Contact Person | Siavash Azimi s_azimi@csdiran.ir 00982142365765 |

| FEAS Membership Status | Affiliate member: Joined FEAS in 2006 |

| Website | www.en.csdiran.ir |

LATEST NEWS

- CSDI has released its quarterly newsletter for Fall 2023

- CSDI Joins Association of Eurasian Central Securities Depositories (AECSD)

- Central Securities Depository of Iran Unveils New Brand Identity at FINEX 2023

- CSDI Summer 2022 Newsletter (Volume 35) Published

- “CSDI & Commodity Exchanges” Bulletin for Spring 2022 covering the period from the 21 March to 21 June

- Children Find Joy as CSDI Families Come Together for After School Party

- CSDI Spring 2022 Newsletter (Volume 34) Published!

- CSDI & Commodity Exchanges Bulletin

- CSDI Newsletter, Volume 33 – Winter 2022

- CSDI & Commodity Exchanges | Bulletin Vol.1, Summer 2021

- CSDI’s First Female Board Member; Another Step Towards Realization of Gender Equality

- Mohammad Baghestani appointed new CEO of Central Securities Depository of Iran

- Hossein Fahimi Reinstated as CEO, Mohammad Sadjad Siahkarzadeh New Chairman of Central Securities Depository of Iran

- Central Securities Depository of Iran Welcomes New Members of the Board of Directors

- Iran Grants 5-Year Residence Permit to Foreigners for $250,000 Investment in Securities Market

- CSDI has released its quarterly newsletter for Winter 2021 covering the period from 19 December, 2020 to 21 March, 2021

- CSDI Signs MOU With Mellat Bank to Issue Credit Cards for Beneficiaries of Justice Shares

- CSDI Has Released Its Quarterly Newsletter for Fall 2020

- Central Securities Depository of Iran Has Held Electronic General Meetings of Five Provincial Investment Companies for the First Time

- 36 Companies Paid Out Dividends Through CSDI’s Sophisticated System “CIGS”

- Online Identity Verification With CSDI’s E-KYC CIGS

- Interview with Mr. Hossein Fahimi | Central Securities Depository of Iran

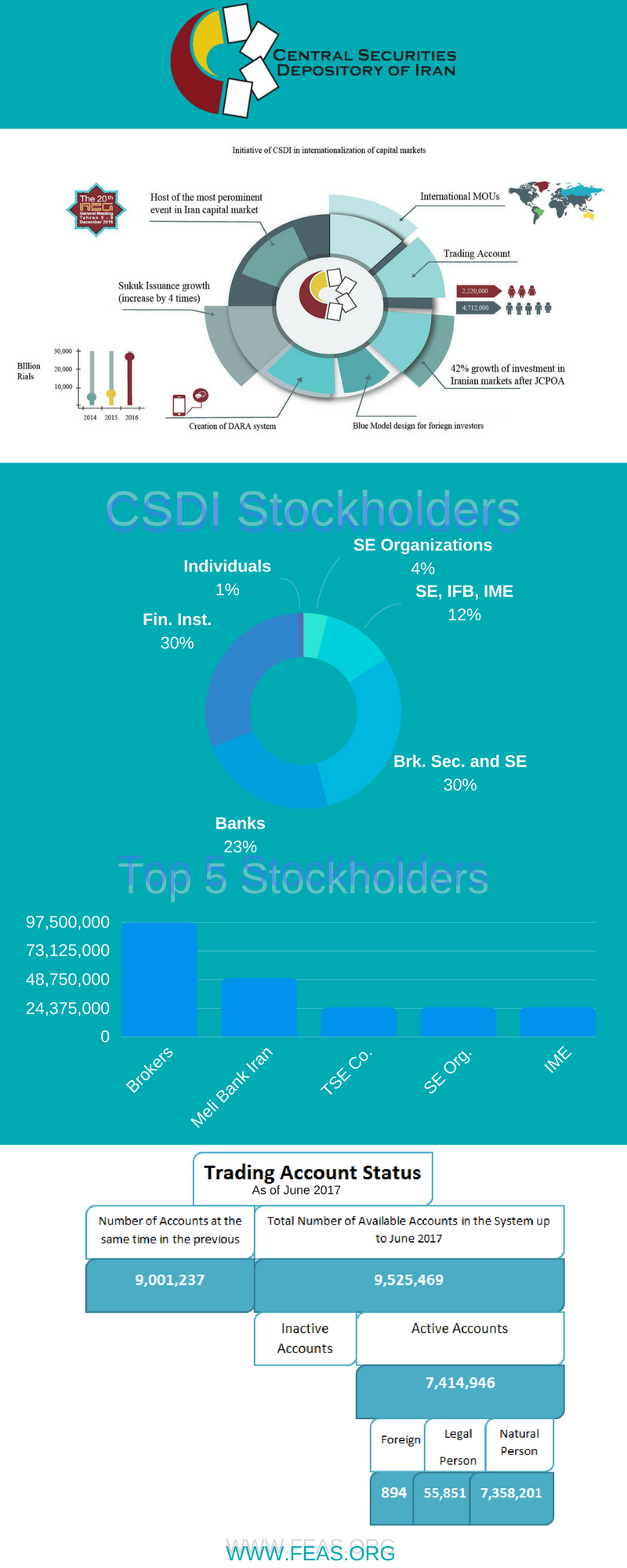

Enjoying a history of more than 50 years, the Iranian capital market was demutualized in 2005 to see the formation of CSDI as the sole registry entity in the Iranian capital market. CSDI’s two subsidiary companies, i.e. Capital Market Central Asset Management Company and SAMATSamaneh have been established in February 2011 and May 2012, respectively. CSDI and its subsidiaries are the Pre-trade and Post-trade infrastructure providersfor Tehran Stock Exchange (TSE), Iran FaraBourse (IFB), Iran Mercantile Exchange (IME), and Iran Energy Exchange (IRENEX).

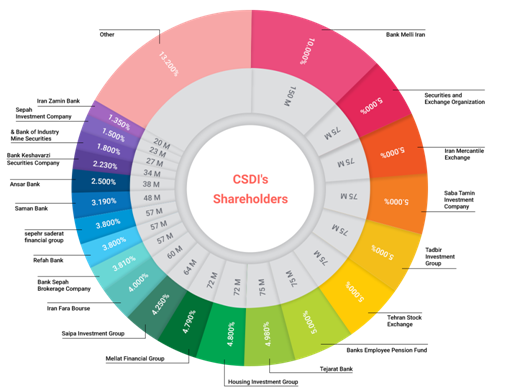

Central Securities Depository of Iran (CSDI) is the sole registrar, clearing house and the major infrastructure provider of Iran’s all four exchanges serving to the shareholders, stakeholders, and participants in the Iranian capital market. CSDI has been established in 2005 as an independent public joint stock company and its capital is made up of 1.5 Billion shares (as of September 2019). The share of the CSDI mostly belongs to Iran’s capital market entities, banks, investment groups, financial groups, brokerage houses, as well as pension funds.

The capital of the CSDI is made up of 1.5 Billion shares (September 2019). The share of the CSDI mostly belongs to Iran’s capital market entities, banks, investment groups, financial groups, brokers, and pension funds.

Although CSDI is a self-regulatory organization (SRO), its operations and procedures are directly supervised by the Securities and Exchange Organization (SEO) as the regulatory and supervisory body in Iran’s capital market. Laws and regulations directly governing CDSI’s activities are listed as below:

- The Securities Market Act of the Islamic Republic of Iran, enacted in 2005 by the Iranian Parliament

- The Law for Development of New Financial Instruments and Institutions

- Articles of the Association of CSDI

- 6th Five Year National Development Plan (2018-2022)

- Iran Permanent Development Act

- The Regulations Governing Registration, Settlement and Clearing System in CSDI.

- Settlement Guarantee Fund Rules, passed by the Securities and Exchange organization in May 2012.

As of July 2019, CSDIhas 118 participants in total, consist of 108 brokerage houses, two banks and eight funds including Capital Market Development Fund, Capital Market Stabilization Fund, and Market Makers.

- CSDI offers the registry, clearing, and settlement services related to the whole range of pre-trade and post-trade activities conducted in Iran’s capital market. In practice, CSDI is the golden source of data and, in the meantime, major infrastructure provider of the whole Iranian capital market, which serves as a gateway to build confidence, promote compliance and provide in-depth and detailed reports to the relevant organizations, both local and international investors, as well as supervisory entities. CSDI also provides its customers with back-office services, and other solutions including, e-KYC, and risk management programs (credit limit, settlement guarantee fund, etc.), as well as corporate action services, including dividend distribution, right issue, raising of capital as well as value-added services (e-Services to investors, issuers, brokers, government services offices), pledging, legal transfer and post-trade services for commodity exchanges (IRENEX and IME).

CSDI provides deposit and settlement services for a wide range of financial instruments. The instruments eligible for CSDI services are listed below:

Preemptive Right, Fixed Income Funds, Hybrid ETF Fund, Construction Funds, ETF/Mutual Fund, ETF Stock, VC Funds, Sukuk, Future, Option, Embedded Option, T-bill, Equity, ETF/Mutual Fund, Energy Project Fund, Debt Securities, Housing Preemptive Right, Index, Electricity and oil contract (for commodity Exchanges), Mortgage-backed security, Depository Receipt, Commodity Certificate of Deposit, Gold coin certificate of Deposit, Certificate of Deposit (CD), Intellectual properties, and Salam Contracts.

There are four Exchanges in Iran, two stock exchanges i.e. Tehran Stock Exchange and Iran Fara Bourse (OTC), and two commodity exchanges i.e. Iran Mercantile Exchange and Iran Energy Exchange.

The wide range of goods and financial instruments are traded in these four exchanges and CSDI provides all pre- and post-trade services including clearing and settlement for them all.

The current settlement method performed by CSDI is DvP2 which is in process to be developed into DvP3 by the end of the current Iranian fiscal year (21 March, 2020). Also CSDI has adopted T+2 settlement cycle for securities transactions in 2018 aimed to reduce operational and systemic risks.

- Risk Management Programs

- Comprehensive Risk Management

- Settlement Guarantee Fund

- Credit limit

- Blue Model(exclusively for foreign investors)

- Dealer Model(exclusively for foreign investors)

- Investors Support

- DARA

- IPS

- e-KYC

- Depository Procedure

- DvP2 which is in process to be developed into DvP3 by the end of the current Iranian fiscal year (21 March, 2020).

- CSDI has adopted T+2 settlement cycle for securities transactions in 2018 aimed to reduce operational and systemic risks.

Working days

| Country | Iran |

|---|---|

| Time Zone | GMT+4:30 |

| Days | Monday / Tuesday / Wednesday / Saturday / Sunday / |

See more

See more  See more

See more