Streak of all-time highs for the capital market in Romania after the Hidroelectrica IPO and crossing the threshold of 150000 investors at BVB

Wednesday, 23 August 2023

The capital market in Romania is going through one of the best periods in its history and has recorded a streak of successive all-time highs in the first 7 months of this year and in July. These include:

- The largest IPO ever made on the Bucharest Stock Exchange (BVB): the Hidroelectrica (H2O) offer worth EUR 1.9 billion (USD 2.1 billion), the largest in Europe and the third largest in the world so far this year.

- The largest number of investors in the Romanian capital market, according to FCI data at the end of the first 6 months: 159,513 investors.

- The highest value of BVB listings: EUR 4.4 billion in the first 7 months, surpassing the entire year 2021, which held the previous record.

- New record for the equity segment on the Regulated Market in terms of total trading value, including offers: RON 16.4 billion, the previous record dating back to 2007 was RON 13.8 billion.

- The highest daily value traded in a single day on the shares segment, without offers: RON 821.3 million on July 12th.

- The highest average daily trading value for all types of instruments on the Regulated Market, without offers: RON 702.48 million in July.

- Most transactions in a single month: 274,717 transactions in July.

- The highest value subscribed by retail investors to an IPO at BVB: RON 6.3 billion to the Hidroelectrica IPO.

- The highest value of transactions resulting from an offer in the retail segment: RON 1.82 billion for the Hidroelectrica offer.

- The largest number of orders subscribed in the retail segment at an IPO in Romania: 51,865 orders.

- The most transactions in one day on the equity segment, the Regulated Market and the Multilateral Trading System, without offers: 23,358 transactions on July 12th.

- New all-time high for BET-TR in July: 26,765 points.

- Record of capitalization of Romanian companies: RON 202.1 billion, the equivalent of EUR 40.9 billion on July 20, 2023.

Radu Hanga, BVB President:

- The capital market in Romania is going through one of the best periods in history and we believe that recent developments confirm that the market is developing in the right direction. The value of Romanian companies listed on the BVB exceeded RON 200 billion, the equivalent of over EUR 40 billion, which is an all-time high for the capital market.

- The Hidroelectrica offer was the largest in Europe and the third in the world so far this year, and the Hidroelectrica phenomenon brought dozens of thousands of Romanians closer to the stock market and demonstrated that Romanians have an appetite for investment, which is encouraging for Romanian companies to get listed on the local stock exchange. More than that, we believe that beyond current records, which can be broken at any time, it is important to keep in mind the overall picture and the essential contribution that the stock exchange institution has in the development of Romania: 170 rounds of financing worth over EUR 10 billion were rolled out in the last 5 years alone through the capital market.

Adrian Tanase, BVB CEO:

- Hidroelectrica’s IPO achieved a performance that was difficult for analysts to predict: it moved 2% of the total types of deposits, expressed in all types of currencies, that the population held in banks after the total subscriptions on the retail tranche reached RON 6.3 billion. This indicator shows what potential the capital market has to attract from the savings of the population in case of significant offers.

- We believe Hidroelectrica is the best testimonial to persuade more and more entrepreneurs to start or resume the listing process because the market has shown that it has an appetite for investments in solid businesses. Romania has become an attractive center for both local and international capital flows as the degree of market development has increased. We are now the third capital market in the region in terms of capitalization and aim to become the third market in the region in terms of liquidity in the medium term as well. Precisely to achieve this desired goal, the implementation of the Central Counterparty project is of utmost importance.

The capital market in Romania is going through one of the best periods in history and has recorded a streak of successive all-time highs in July and in the first 7 months of this year. The offer of Hidroelectrica (H2O), a leader in electricity production and the main provider of technological services needed in the National Energy System, which was held at the Bucharest Stock Exchange (BVB) between June 23 and July 4, 2023, ended successfully and became the largest initial public offering (IPO) ever made on the Romanian stock market. Hidrolectrica’s IPO attracted a total of RON 9.28 billion (about EUR 1.9 billion EUR or USD 2.1 billion) for 89.7 million shares representing 19.94% of the total number of shares and became the largest IPO in Europe and the third largest in the world considering the IPOs so far this year. Hidroelectrica debuted on July 12th on the BVB’s Regulated Market and is the largest Romanian company listed on the BVB in terms of market capitalization.

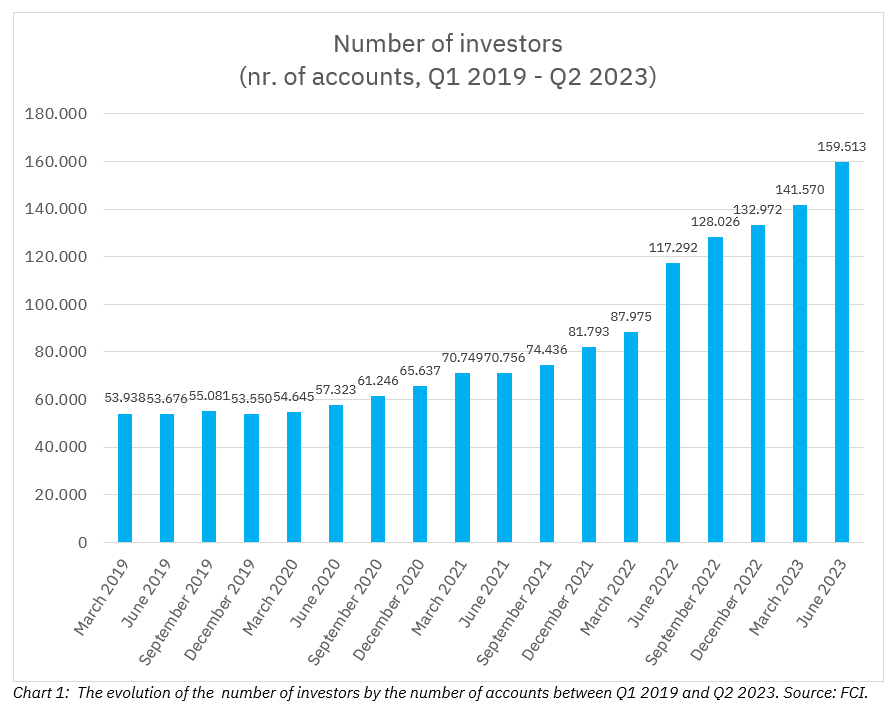

The number of investors in the Romanian capital market continued to grow and reached almost 160,000 investors at the end of the first semester of 2023, according to data from the Investor Compensation Fund (FCI). By comparison, in 2019 there were almost 54,000 investors. This represents a 200% increase over the past five years. Moreover, once the threshold of 150,000 investors was exceeded, the capital market in Romania reached a new all-time high. The evolution of this indicator can be seen in Chart 1.

Radu Hanga, President of the Bucharest Stock Exchange said: „The capital market in Romania is going through one of the best periods in history and we believe that recent developments confirm that the market is developing in the right direction. The value of Romanian companies listed on the BVB exceeded RON 200 billion, the equivalent of over EUR 40 billion, which is an all-time high for the capital market. The Hidroelectrica offer was the largest in Europe and the third in the world so far this year, and the Hidroelectrica phenomenon brought dozens of thousands of Romanians closer to the stock market and demonstrated that Romanians have an appetite for investment, which is encouraging for Romanian companies to get listed on the local stock exchange. More than that, we believe that beyond current records, which can be broken at any time, it is important to keep in mind the overall picture and the essential contribution that the stock exchange institution has in the development of Romania: 170 rounds of financing worth over EUR 10 billion were rolled out in the last 5 years alone through the capital market.”

Adrian Tanase, CEO of the Bucharest Stock Exchange said: „Hidroelectrica’s IPO achieved a performance that was difficult for analysts to predict: it moved 2% of the total types of deposits, expressed in all types of currencies, that the population held in banks after the total subscriptions on the retail tranche reached RON 6.3 billion. This indicator shows what potential the capital market has to attract from the savings of the population in case of significant offers. We believe Hidroelectrica is the best testimonial to persuade more and more entrepreneurs to start or resume the listing process because the market has shown that it has an appetite for investments in solid businesses. Romania has become an attractive center for both local and international capital flows as the degree of market development has increased. We are now the third capital market in the region in terms of capitalization and aim to become the third market in the region in terms of liquidity in the medium term as well. Precisely to achieve this desired goal, the implementation of the Central Counterparty project is of utmost importance.”

The value of the listings made at the Bucharest Stock Exchange in the first 7 months of this year stood at EUR 4.4 billion, thus surpassing the entire year 2021, which had held the previous record, when the value of all instruments listed on the BVB that year was around EUR 4 billion. Also in the first 7 months of this year, a new record was set for the equity segment on the Regulated Market in terms of total trading value, including offers. More precisely, this value reached RON 16.4 billion, the previous record of RON 13.8 billion dating from 2007. Also at the level of liquidity, the highest daily value traded in a single day on the equity segment, not including offers, was recorded on July 12th, with transactions totaling RON 821.3 million. In July, the highest average daily trading value for all types of instruments on the Regulated Market, without offers, also reached an all-time high: RON 702.48 million. In addition, July 2023 was the month in which the most monthly transactions were carried out at the BVB level, namely 274,717 transactions.

Hidroelectrica’s IPO also recorded a series of all-time highs for the segment related to retail investors. Thus, during the offer, the highest value subscribed by retail investors to an IPO at BVB was registered: RON 6.3 billion at the Hidroelectrica IPO. Also within the H2O offer, the highest value of transactions resulting from an offer in the retail segment was recorded: RON 1.82 billion, as well as the highest number of orders subscribed in the retail segment at an IPO in Romania: 51,865 orders. After H2O entered trading at the BVB, another record was set on July 12th: the most transactions made in one day on the equity segment, the Regulated Market and the Multilateral Trading System, without offers: 23,358 transactions.

The Romanian capital market grew by 17.5% in the first seven months of this year, according to the BET-TR index, which also includes dividends. At the end of the trading session on July 31st, BET-TR showed a level of 26,647 points, and the all-time high reached since its establishment 11 years ago was recorded on July 20, 2023, when BET-TR reached 26,765 points. Also during this time, BET-NG, the index of energy and utilities companies, was up 16.9%.

A new record was registered regarding the capitalization of Romanian companies and the highest recorded value for this indicator was posted on July 20, 2023. On that date, the market value of all Romanian companies listed on the BVB reached a level of RON 202.1 billion, equivalent to EUR 40.9 billion.