Cyprus Stock Exchange

Nicos Tripatsas

Acting General Manager

| Address | 71-73 Lordou Vironos Avenue, 1096 P.O.BOX 25427 Nicosia 1309 Cyprus |

|---|---|

| Telephone | +35722 712300 |

| info@cse.com.cy | |

| Contact Person | Michalis Michael info@cse.com.cy |

| FEAS Membership Status | Full member: Joined FEAS in 2016 |

| Website | www.cse.com.cy |

LATEST NEWS

- Cyprus Stock Exchange Bulletin for January 2024

- Cyprus Stock Exchange Monthly Newsletter September 2022

- Cyprus Stock Exchange Monthly Bulletin: July 2022

- Cyprus Stock Exchange Monthly Bulletin for April 2022

- Cyprus Stock Exchange Monthly Bulletin for March 2022

- Cyprus Stock Exchange Monthly Bulletin for February 2022

- Cyprus Stock Exchange Monthly Statistical Issue: January 2022

- Athens Exchange Group and Cyprus Stock Exchange cooperate for the purpose of complying to EU Settlement Discipline Regulation (SDR) and the facilitation of Investor CSD capability by CSE

- Cyprus Stock Exchange Monthly Bulletin July 2020

- Cyprus Stock Exchange Monthly Bulletin May 2020

- Cyprus Stock Exchange Monthly Bulletin March 2020

- Announcement from Cyprus Stock Exchange

- Interview with Mr. Nicos Trypatsas | Cyprus Stock Exchange

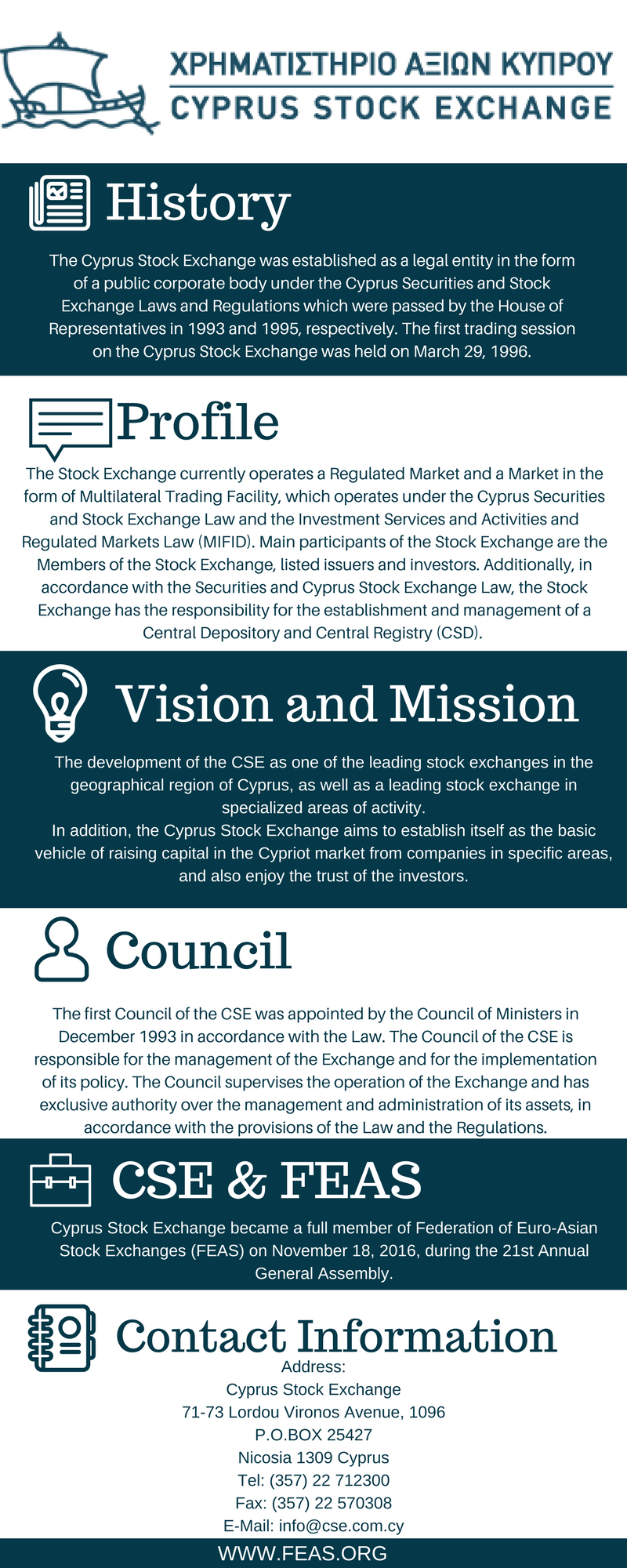

The Cyprus Stock Exchange was established as a legal entity in the form of a public corporate body under the Cyprus Securities and Stock Exchange Laws and Regulations which were passed by the House of Representatives in 1993 and 1995, respectively. The first trading session on the Cyprus Stock Exchange was held on March 29, 1996.

The Stock Exchange currently operates a Regulated Market and a Market in the form of Multilateral Trading Facility ( the ‘Emerging Companies Market’), which operate under the Cyprus Securities and Stock Exchange Law and the Investment Services and Activities and Regulated Markets Law (MIFID). Main participants of the Stock Exchange are the Members of the Stock Exchange (brokerage offices), listed issuers and investors.

Additionally, in accordance with the Securities and Cyprus Stock Exchange (Central Securities Depository and Central Registry) Law, the Stock Exchange has the responsibility for the establishment and management of a Central Depository and Central Registry (CSD). Securities listed on the Cyprus Stock Exchange are registered in the CSD and also unlisted securities, whose issuer wishes the maintaining of the registry by the Cyprus Stock Exchange.

| Regulator | The Cyprus Securities and Exchange Commission | |

| Instrument List | Shares/ Warrants/ Rights/ Corporate bonds/ Government bonds/ Treasury bills/ Investment funds and GDRs | |

| Trading Hours/Sessions | Main Market | 10:15 – 17:20 |

| Alternative Market | 10:15 – 17:20 | |

| Global Depositary Receipts | 10:15 – 17:20 | |

| Surveillance Market | 10:15 – 17:20 | |

| Corporate Bond Market | 10:32 – 17:20 | |

| Government Bond Market | 10:32 – 17:20 | |

| Non-Regulated Markets | 10:15 – 17:20 | |

| Order Types | Market Order/ Limit Order/ At The Ope/ At the Close/ Stop/ Immediate or Cancel/ Fill or Kill / Good For Day/ The Good Till Date/ The Good Till Cancel | |

| Spreads | Main Market/Alternative Market/Surveillance Market | The first price fluctuation range shall be +10% or -10% of the security’s starting price (reference price). In case buy orders at limit up or sell orders at limit down remain unmatched at best bids/offers for 15 continuous minutes of the hour, the daily fluctuation range extends to +20% or -20% respectively of the starting price. |

| Global Depositary Receipts | The Global Depository Receipts trading price ranges in the same potential percentage as the daily fluctuation price limit of the underlying security at the market traded primarily, unless the CSE Council decides otherwise. This percentage will be published with their listing for trading at the CSE. | |

| Corporate Bond Market/Government Bond Market | The first price fluctuation limit will be + 30% or -30% from the starting price (reference price) If buy orders on the ceiling price or sell orders on the floor price remain unexecuted at the best buy or sell prices for 15 consecutive minutes, the daily price fluctuation limit is extended to + 60% and -60% respectively from the starting price. | |

| Non-Regulated Markets | In accordance with the rules are the same as the regulated market | |

| Margin Buying/Short Selling | Yes | |

| OTC | Yes | |

| Settlement Types | DVP | |

| Settlement Cycle | T+2 | |

| Settlement Currency | Euro | |

| Clearing/Netting | Yes | |

| Cross-border Transactions | No | |

| Cross-border Links | The CSE has indirect link with Clearstream Banking Luxemburg (CBL) through an International Custodian who acts as a Custodian / Operator of the CSD. | |

| Anti-money laundering Requirements | AML procedures are followed by the CSE Participants supervised by the Cyprus Securities and Exchange Commission. | |

| IOSCO Membership | No | |

Working days

| Country | Cyprus |

|---|---|

| Time Zone | GMT+3 |

| Days | Monday / Tuesday / Wednesday / Thursday / Friday / |

See more

See more  See more

See more