Iran Fara Bourse

Mohammad Ali Shirazi

CEO

| Address | No.1, North Didar, Haghani Hwy, Tehran, Iran |

|---|---|

| Telephone | +982142150218 |

| Fax | +982142150519 |

| info@ifb.ir | |

| Contact Person | Maryam Ramezani ramezani@ifb.ir |

| FEAS Membership Status | Full member: Joined FEAS in 2013 |

| Website | www.ifb.ir |

LATEST NEWS

- OTC Market Officially Launched by IFB

- Iran Fara Bourse Welcomes a New CEO

- Iran Fara Bourse: Shareholders Approve 99 IRR Dividend Per Share and Elect New Board Members

- Sunday Unmediated Communication to Iran Fara Bourse CEO

- Iran Fara Bourse: New Instructions to Facilitate Market-makers

- Mr Meysam Fadaee Is Now Sitting After Mr Hamooni as The Acting CEO of Iran Fara Bourse

- FEAS Members celebrate World Investor Week 2021

- Iran Fara Bourse held the Annual General Assembly Meeting fully online with “Didar Platform”, an in-house developed solution.

- Opening of the “Crowdfunding Market” and “Sukuk Index (Sindex)” at Iran Fara Bourse

- IFB Signed a MoU Aimed at Supporting the Development of the Wider Iran Capital Market

- Another First and Best Again by Iran Fara Bourse

- Iran Fara Bourse CEO Re-appointment for Two More Years

- First “Productive Credit Certificate” So-called Gam Securities in the Capital Market Goes to Sepah Bank

- Iran Fara Bourse signs MoU with Allameh Tabataba’i University, The Centre of Excellence in Mathematical Finance

- IFB celebrated the IPO of Pegah Gilan Co. today!

- Iran Fara Bourse Negotiation Trades Board to launch

- Interview with Dr. Neda Bashiri | Iran Fara Bourse

- Interview with Mr. Amir Hamooni | Iran Fara Bourse

- An Interview with Amir Hamooni

- An interview with Mahsa Tavakoli at the 24th Annual General Assembly of FEAS

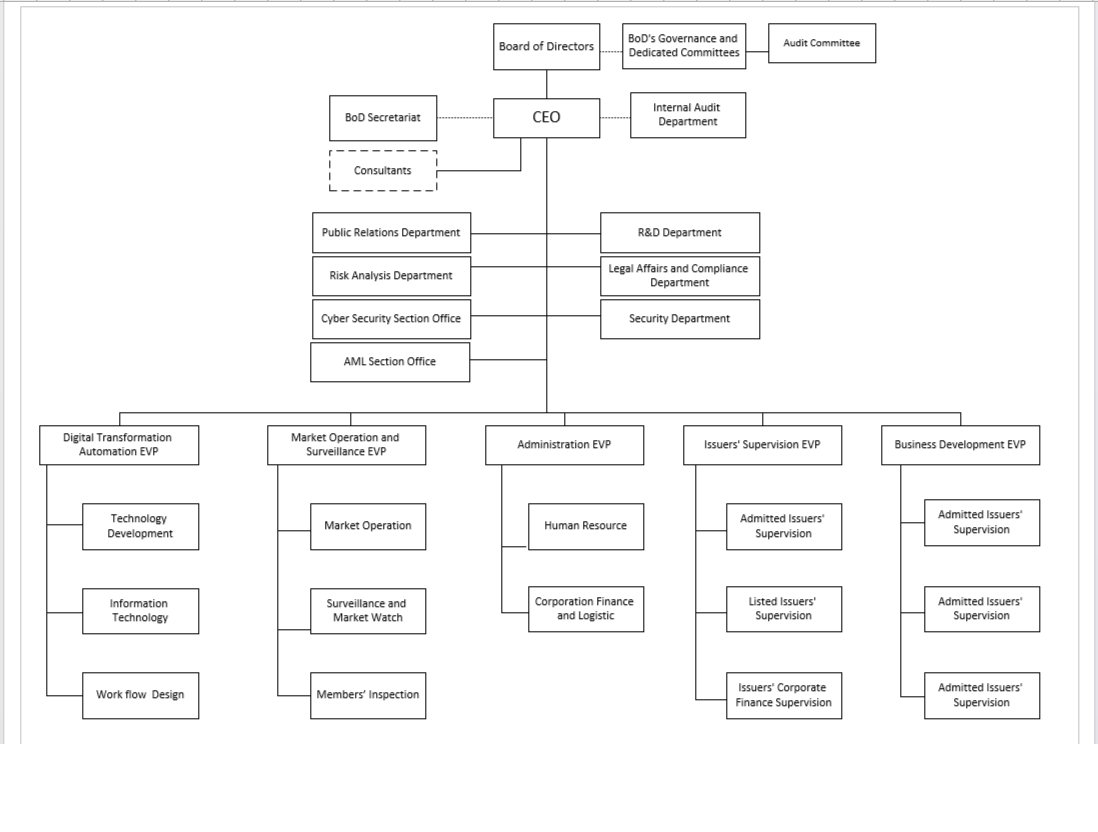

Iran Fara Bourse Securities Exchange (IFB), one of the four Iranian Exchanges, operates under supervision of Securities and Exchange Organization (SEO), a member of IOSCO. IFB was established on November 12, 2008, to be a gate for majority of companies to enter the capital market and enhance their corporate governance and their businesses by providing easier listing requirements.

Providing IPO and Trading services to the listed companies, IFB sets a strategy to diversify the range of instruments to respond to every risk appetite in the market and every need for fund raising for the entire lifecycle of the companies, by securitizing assets and liabilities.

Nowadays, Iran Fara Bourse offers a wide range of products and services to the market; Listing, IPOs and Trading in different sections of Equity market as well as providing a platform for Unlisted Securities Trading (UTP). Also, In Structured Financial Products Market (SFP), various types of Sukuk, CDs, Mortgage Rights and Funds are available.

Additionally, IFB owns a market for Privatization of Government-linked Companies (GLCs), holds Mergers and Acquisitions as well as Intellectual Property listing. And recently few derivatives instrument were added to the list of securities at IFB which will be more and deeper in near future.

| Regulator | Securities and Exchange Organization | |

| Instrument List | Share / Sukuk / Mortgage back Security/ Certificat of deposit / Housing Mortgage Right / ETF’s / ETPF / Intelectual property / Islamic Treasury bill | |

| Trading Hours/Sessions | Pre-opening Session | 08:30 – 09:00 |

| Trading Session | 09:00 – 12:30 | |

| Order Types | Limit order (in use) / Market on opening order (not used) / Market order(not used) / Stop order(not used) / Market to limit order(not used) | |

| Spreads | ±5 | |

| Margin Buying/Short Selling | Not Released Yet | |

| OTC | Yes | |

| Settlement Types | DVP | |

| Settlement Cycle | For equities (T+2) / For bonds and T-bills (T+1) | |

| Settlement Currency | Iranan Rial | |

| Clearing/Netting | DVP | |

| Cross-border Transactions | Foreign investment is allowed in the capital market. | |

| Cross-border Links | NON | |

| Anti-money laundering Requirements | Rules by Anti-money laundering unit and supreme council | |

| IOSCO Membership | Yes (ordinary member) | |

Working days

| Country | Iran |

|---|---|

| Time Zone | GMT+4:30 |

| Days | Monday / Tuesday / Wednesday / Saturday / Sunday / |

See more

See more  See more

See more